Table of Content

Furthermore, the LIC housing loan calculator also displays the total repayment liability that she has to pay amounting to Rs. 56,62,618. They offer housing loans to Indian and Non-Indian residents as well as pensioners. Also, while deciding EMIs, borrowers can use the LIC home loan calculator and go for the most convenient loan amount that keeps EMIs affordable. The housing finance company was established in 1989 to financially assist individuals who wish to construct or purchase a residential property. Later, LIC Housing Finance Limited became a public company in 1994, promoted and controlled by the LIC of India.

The applicant for home loan in LIC HFL needs to meet the age requirement and possess all necessary identity and income proof required to apply for the loan. The LIC HFL home loan interest rate starts at 8.50% to 8.70%, but varies as per individual profile. Keep a check on this page to note the updated LIC HFL home loan interest rates for the current year. There are different types of loan schemes that an individual can choose according to their choice and requirement. These differ in case someone wants loan for house construction/purchase or renovation. Went public in 1994,LIC Housing Finance is India’s largest and most trusted housing finance company, which has been offering finance services to individuals who want to buy or renovate their homes.

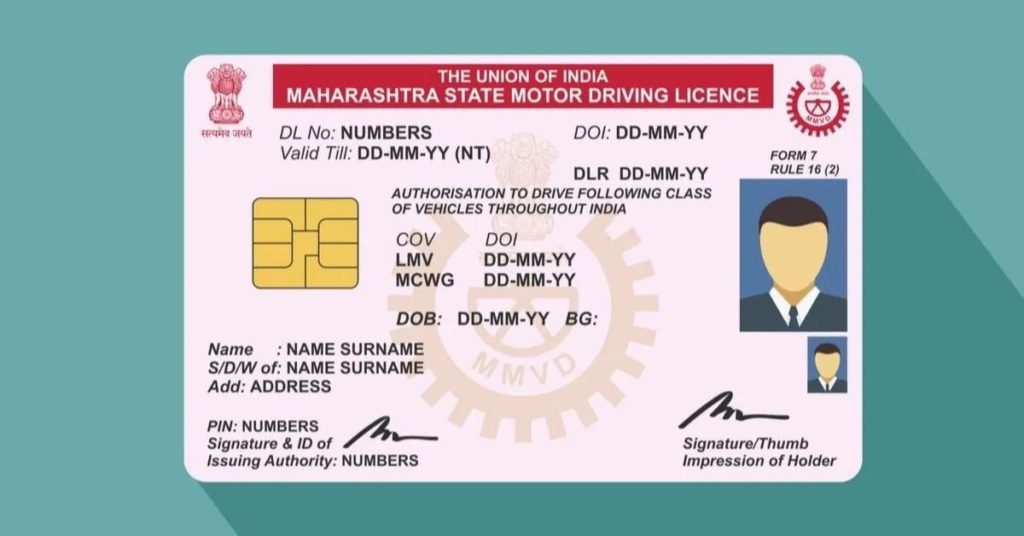

LIC Home Loan Eligibility Documents

As mentioned earlier, the home loan lenders determine the eligibility of an applicant for home loan on the basis of their monthly income . The salary is taken into consideration to identify the loan repayment capability of the applicant. The LTV ratio or the Loan-to-Value ratio is used to assess the risk factor involved in the case of a loan disbursal. About LIC Housing – LIC is a major housing finance company, that provides long term finance to individuals for purchase or construction of a house or flat for repair and renovation of flats/houses. The non-resident Indian customers can avail these loans for purchase or construction of new house or extension of the existing one.

For over 20 years, LIC HFL is providing various types of home loansincluding purchase of a ready property or under-construction property, construction of a house, plot purchase loans to home-renovation loans and others. LIC HFL offers Home loans to Resident Indian Salaried Individuals, Self-Employed individuals and pensioners. Salaried NRIs customerscan also avail home loan from LIC HFL with one of the lowest interest rate compared to the other home loan providers of the country. To be eligible to take a home loan from LIC housing finance limited, each of the loan applicant/s should have minimum CIBIL Score of 650. Your CIBIL score depends on your repayment track on existing and closed loans and Credit Cards. If you are not paying you EMIs on time you will have a very poor CIBIL score build up,a poor CIBIL score will make you an ineligible home loan applicant in LIC Housing Finance.

LIC Housing Finance Home Loan Benefits& Features for NRIs

The loans can be availed for the purchase or construction of a new house or for extension of an existing unit. The loan can be availed for a term up to 15 years, the maximum age criteria being 70 years. Will I be eligible for a home loan if I have a bad credit score? In case you have a poor credit score, it will be difficult for you to get a home loan. Banks or financial institutions consider your credit report to be of great value while determining your eligibility towards a loan.

They must also remember that a fractional difference in a home loan amount or interest rate can increase the total outstanding significantly as it is a high-value advance that comes with an extended tenor. So, borrowers must be careful about all the terms before applying for it. As a convenient option, one can consider using the LIC home loan EMI calculator that computes the payout options within seconds. Individuals need to provide their desired advance amount, applicable interest rate, and repayment term to the calculator, which displays the resultant EMI accordingly. If you buy a second house on a home loan, then the tax benefits applicable are on the interest payment only.

LIC Housing Finance Home Loan for Non-Resident Indian

Banks and NBFCs assess loan eligibility and repayment capacity of candidates before approving their loan application. It is a credit score indicating how regular you have been with previous loan repayments, and how regular you are with ongoing payments. If you make timely payments, your credit score will increase, and vice-versa. A good CIBIL score signifies that you are a reliable candidate to lend money to, and financial institutions will easily approve a housing loan if you have a good CIBIL score and a strong repayment capacity. The loan can be availed only to bear the cost of construction of a new house. The actual loan value depends on the property cost, i.e., for loans up to 20 lakhs, one can avail 85% of the property cost including registration charges and stamp duty.

But these individuals must be applying for home loans for residential purposes. It can be construction of a new home, its renovation or extension as well as repair. Loan types and process to get on them is easy and trustworthy.

The company offers a number of loan services, ranging from purchase, construction, repair, renovation, loan against property and loans for professional. LIC home loan has very low processing fees compared to the industry on all its home loan offers and schemes. Other charges are also comparatively lower than other lenders of the country.

Once you have figured out your eligibility for a home loan, you can check home loan interest rate for all banks and apply for the one that suits you best. It is an interest subsidy of up to Rs 2.67 lakh for the borrowers' first pucca house construction/purchase. LIC Charges customers with a processing fee of up to 0.35% of the loan amount + GST. If you have taken a LIC home loan at a floating interest rate, then you can easily make prepayments without paying any extra charges. On the basis of this formula, you get the pie-chart representation for the monthly payment , the total interest payable, and the total payment (interest+principal). Other than this, you also get the amortization table showing the details of maturity value for each year throughout the tenure.

You can get an LIC Housing Home Loan for the purpose of home construction, buying a home, home improvement or plot purchase for an amount as low as Rs.1 lakh. These loans are offered to people who have reached the retirement age or approaching to it. The loans are provided in comfortable terms complying with simple requirements.

A moratorium period is a time period wherein you as a borrower do not have to repay any amount. It is often known as EMI holiday at times because in this tenure, you do not repay towards the loan. It is a waiting duration before you start paying the EMIs as specified in the loan agreement. Without a moratorium period, a person has to start paying the monthly instalments from the day 1 of the loan till the final day of the tenure. To avail additional tax deductions, you can rent another house where you live, at the same time of claiming home loan tax benefits.

The tax exemptions are on completed construction of property or when you buy a ready-to-move-in property. The advantage of this loan is its same interest throughout the duration, if fixed, but flexible on floating rate of interest. Foreclosure letter, loan account statement and original documents. Customer feedback form signed by the individual transferring the loan. More than 150 offices of the company in the country have experienced professionals to help and understand the procedure of loan approval depending on one’s requirement and budget. LIC HFL offers loan amount from Rs. 100,000 to Rs. 1,00,00000.

LIC Housing Finance providesHome loans to Indian Residents working with various MNCs operating in India, Indian Private sector companies or Public sector enterprises, Defence Services etc. LIC offers higher tenure to salaried Indian applicants compare to self-employed category and NRIs. Interest rate– Although lenders determine interest rates, an applicant’s qualification measures like age, repayment capacity, credit profile, and similar other factors can influence it. Notably, an expensive rate of interest keeps the EMIs on a higher side.

LIC Housing Finance offers a range of products to NRIs and PIOs under home loan schemes, the product covers all the type of loans for purchase of different type of properties as per the exact need of a NRI/PIO customer. The minimum age of the potential borrower should be 18 years for both salaried and self-employed individuals, while the maximum age is 65years. Tranche basis and as per the stage of construction of the bungalow.

If you have a good score, banks will be happy to offer you a home loan with attractive rates of interest. However, with a bad score lenders will doubt your repayment capability and might not consider you to eligible for a home loan. LIC Housing Finance Limited offers Home Loans at one of the lowest rates – 6.90%. These loans are available to salaried, self-employed and pensioners, with women borrowers eligible for additional interest concession.

No comments:

Post a Comment